A freedom of information request submitted by SRNews has revealed South Tyneside’s pension fund has been invested in a private equity company named in the Paradise Papers, as well as a tobacco company.

The public sector pension scheme, controlled by South Tyneside Council, manages the future savings of public sector workers living in Sunderland, Newcastle, Gateshead, as well as North and South Tyneside.

The pot, invested to generate more revenue for the department, is forged from investment income, employees’ contributions and employers’ contributions. The last evaluation of the fund estimated its market value to be around £8.2billion at the end of October.

One of the fund’s nine external managers, appointed to oversee equity and bond mandates, invested £30million of it into multibillion-dollar private equity partnership Coller International Partners IV, based in the Cayman Islands, a tax haven popular with American and British hedge funds.

Private equity refers to (usually overseas) investment funds organised as limited partnerships, which are not publicly traded so they cannot be found on the stock market. At the time of publication, Coller had attracted £4.8bn in capital from almost 200 public institutions, including Oxford and Cambridge universities.

Investing in an offshore fund in this way isn’t illegal, and in no way is SRNews accusing Tyneside Council of any illegal activity. Money can be routed through what are known as ‘blocker’ corporations, which relieves investors of the administrative burden (cost) of engaging directly with tax authorities.

This revelation comes just weeks after the ‘tax-free blacklist’ paradise papers were leaked, which detailed offshore tax-free havens where people — including The Queen, Lewis Hamilton and Bono — were routing money to make it tax-free.

The pension department also invested £52m of public sector pension money into British American Tobacco, who make popular brands Lucky Strike, Pall Mall and Rothmans as well as e-cigarette brands Vype and Vapour.

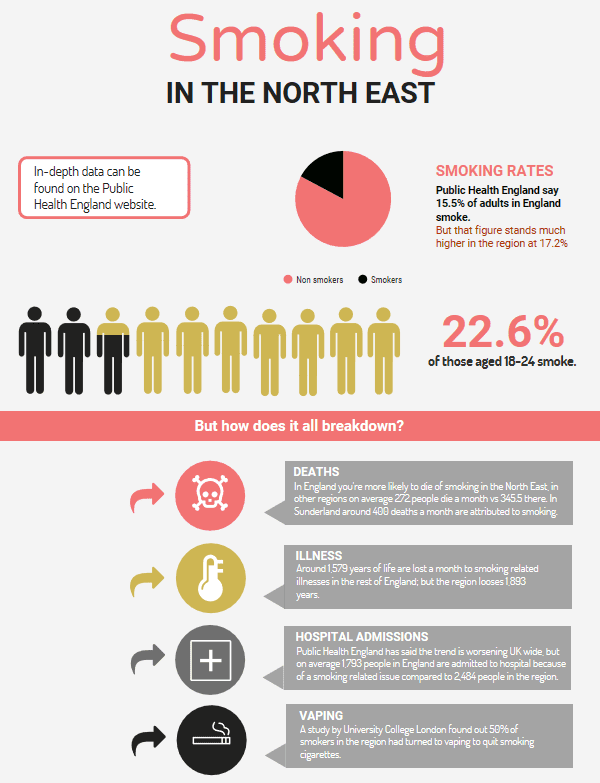

Tobacco is the biggest preventable illness and killer in the North East – historically the region has held the title for the worst smoking rates and hospital admissions in the country.

In 2016, the Office for National Statistics (ONS) confirmed history was repeating itself, by showing that 17.2 per cent of adults in the North East were smoking regularly. This is compared to the average of 15.5 per cent in England.

Smoking habits in the region are the worst in England.

Smoking habits in the region are the worst in England.

Perhaps even more startling, young folk in the North East are the most likely in England to smoke. ONS data shows 22.6 per cent of the North East’s 18-24-year-olds are smokers, which is the third highest rate in England, behind the South East (23.2%) and the South West (22.8%).

Ailsa Rutter, Director of the region’s anti-smoking charity Fresh, stated that investments of these kinds are a national problem: “Nationally, many councils are looking long-term at how pension fund management can disinvest from tobacco companies particularly as smoking rates decline and there is increasing regulation on such lethal products. This is something we support.”

When questioned, Labour councillor Iain Kay said: “The responsibility for managing the funds rests solely with the trustees who work closely with professional advisors to ensure value for money within the funds. Whilst each council appoints a member to the steering committee, there are strict rules to prevent what could be seen as political interference in the process of how the funds are managed.”

Although he did seem to acknowledge the ethical dilemma of the decisions: “Inevitably, there are circumstances where some investment decisions are made that individual members may not approve of, but the fund does follow clear legal guidelines not to invest in markets or organisations that are subject to government sanctions etc.”

Regional Co-Ordinator of the North East Green Party, Shirley Ford, said they have already called on the fund to cut ties with fossil fuel companies, but is extremely concerned with both of these revelations.

She said: “We would condemn, in the strongest terms, investments in a company such as British American Tobacco. This is completely unethical and flies in the face of all five councils’ public health policies to reduce the harmful impact of smoking.

“It is particularly damaging as this region has the highest rates of people smoking, causing high numbers of deaths, serious illnesses and hospital admissions.”

She was also alarmed by their equity choice: “We are also appalled by the investments in private equity companies – at least one of which has been named in the Paradise Papers. This again goes against what any public body should invest in, as this kind of business practice is all about avoiding paying a fair share of tax.

“It is also hypocritical as these are investment decisions made by the administrators of a pension fund, led by a Labour-run council, on behalf all five Labour-run councils, and yet it contradicts national Labour Party statements condemning such offshore tax havens and the companies that take advantage of them.”

Ford wants the fund to change their decisions: “We call on the administrators of the pension fund to immediately alter their investment policies and to disinvest their money from these unethical companies.”

She also suggested an alternative: “Instead they should be investing in renewable energy companies and social housing, investments which would also create many jobs in this area and benefit the common good.”

Conservative Councillor and Sunderland Council Group Leader, Robert Oliver, says he is shocked with the Labour council’s practice:

“Smoking is the biggest health problem faced by the people of Sunderland so it is totally wrong that local government pensions are invested in tobacco companies and the council should make a stand by instructing the pension fund to sell the shares and invest in more ethical companies.”

He was also concerned about their offshore investment: “Some people in the Labour Party have been vocal in condemning investments in offshore funds that avoid tax and are secretive so the council should follow the lead of other institutions and divest from these funds into ones that pay full UK tax and are open about their holdings.”

Several North East Labour MPs spoke out when the Paradise Papers investigation was first published by the BBC and the Guardian in November. Easington MP Grahame Morris said: “Labour will end the era of government turning a blind eye to the scandal of tax avoidance.”

North West Durham MP Laura Pidcock tweeted: “#Paradise Papers show that morality doesn’t factor in the decisions of the richest. Accumulating wealth for wealth’s sake, at expense of society.”

#ParadisePapers show that morality doesn’t factor in the decisions of richest. Accumulating wealth for wealth’s sake, at expense of society.

— Laura Pidcock MP (@LauraPidcockMP) November 5, 2017

Gateshead’s Ian Mearns MP added: “Every pound avoided by the greedy super rich is a pound needed by our NHS and schools. We’ll curtail tax evasion/avoidance. #ParadisePapers”

Every pound avoided by the greedy super rich is a pound needed by our NHS and schools. We’ll curtail tax evasion/avoidance. #ParadisePapers

— Ian Mearns MP (@IanMearnsMP) November 5, 2017

A spokesperson for the Tyne and Wear Local Government Pension Fund, said: “The approach to investing the Fund is set out in the Pension Committee’s Investment Strategy Statement.

“This document covers the extent to which social, environmental and ethical considerations are taken into account in the selection, retention and realisation of investments.

“Investment Managers consider social, environmental and ethical issues as integral parts of their investment process and act accordingly where such issues may have a financial impact on investment.”